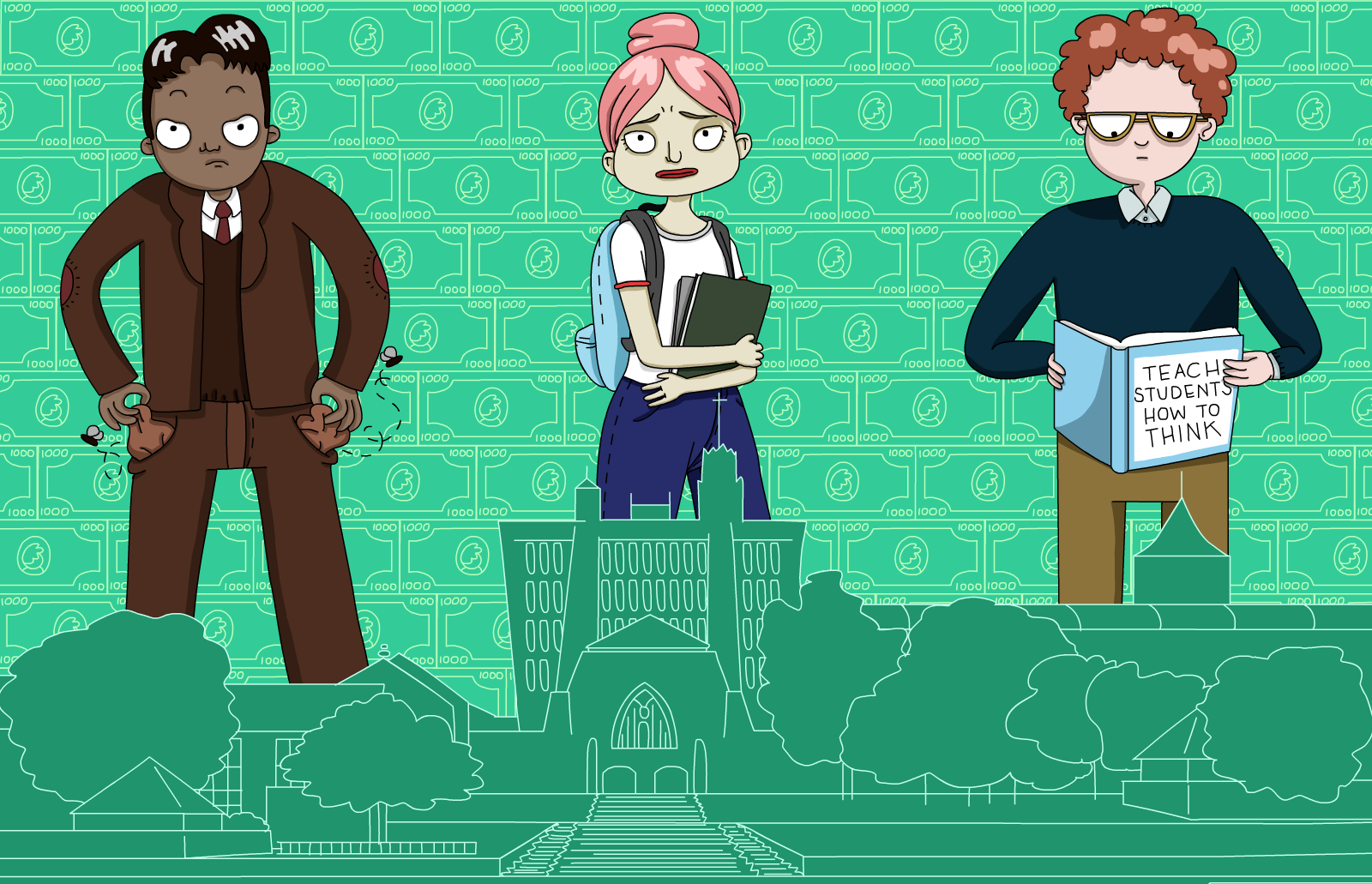

Caribbean Student Loans Shouldn’t Be This Complicated

Words and Graphics By Melisa Boutin

It took eight years for me to find out that my student loan turned into an interest only loan. That’s right, eight years after I started repaying my student loan from my local Development Bank, in St. Kitts and Nevis, is when I realized that the first year of my monthly student loan payments went to interest only. But how did this happen? Like any responsible borrower, I promptly made the first required payment six months after graduating from college and even requested a copy of my student loan promissory note, to make sure that I was adequately informed about the terms and conditions to which I agreed.

After sharing my experience with other borrowers and researching the student loan system in the Eastern Caribbean, I learned that the confusion I had about how my student loan worked, was a far too common experience. In fact, our collective experiences mirrored the survey responses summarized in a Universalia report of the 2004 assessment of the Student Loan Scheme in the Eastern Caribbean, Belize and dependent territories. This scheme was initiated in the Organization of Eastern Caribbean States member countries, which include my homeland, St. Kitts and Nevis, in 1972, by the Caribbean Development Bank. This assessment highlighted the need for student loan lenders to improve communication with borrowers, thoroughly explain billing practices and remind students of the student loan terms and conditions and the implications throughout the loan cycle.”

At the same time that the assessment of the Eastern Caribbean Student Loan Scheme was underway in 2004, Tasha Nicholas-Aziz, my childhood friend, applied and was approved for a student loan from the Development Bank of St. Kitts and Nevis. Tasha was exactly the type of person the Caribbean Development Bank had in mind when the Student Loan Scheme was established to aid in fulfilling its mission of systematic poverty reduction through improving access to tertiary education in the Caribbean Region. She came from a poor family, and both of her parents did not graduate from high school. She was the first in her immediate family to graduate from high school and would be the first to attend college. The approval process was no easy feat for Tasha. As the 2005 Student Loan Scheme Assessment report highlighted, the student loan terms and conditions, “generate a series of hardships for students, both during the study period and in the years following graduation.” Tasha faced many of those hardships and more.

“I don’t regret getting an education and I don’t regret my choice for not returning home. My only regret is my student loan. I wish I had better lender options. The options I had did not serve me well,” Tasha reflected on her experience with her Student Loan from the Develop Bank of St. Kitts and Nevis. “There’s no transparency in the process, and [the Bank] takes advantage of people who are already disadvantaged, because they know this is your only resource.”

Tasha was approved for a student loan to complete an associate’s degree in the United States from the Development Bank of St. Kitts & Nevis in 2004. She overcame the first hurdle to attending college, which was securing financing in spite of the stringent guarantee and security conditions, including having an acceptable the co-signer and property as collateral. Her uncle helped her out with both requirements. Just a year and 6 months after starting college, she received disturbing news after submitting a disbursement request to the Development Bank of St. Kitts and Nevis for funds to cover her tuition and fees.

“My mother called her and told me that there were no more funds left,” Tasha reflected.

“[The Bank] never explained to me what happened. I was trying to figure out why there was no money left. They just told me that they disbursed all the funds in the form of a cheque to your mother.”

“They never sent me a notification of what was disbursed, if they had I would have known something is wrong.”

At this point, too, Tasha had never received an account statement while she had been attending school and it was not an unusual occurrence. Not providing account statements to borrowers during the entire in-school period was a regular practice by the Bank. During my five years in college, I also never received an account statement or receipts of what transactions transpired on my student loan account. This is a practice that the 2005 Universalia assessment report recommends against.

Tasha had to withdraw from school and use the funds she had left to return to St. Kitts and Nevis to get answers.

“I thought they would work out whatever they needed to work out with my mother because they made the mistake of disbursing more funds than I requested. I was not the one who made the error,” she remembered thinking.

Instead of getting answers and resolution, Tasha was issued another set of funds to finish her associate’s degree and this amount was added to her student loan balance. No further explanation or written documentation was provided on erroneously disbursed funds.

With my own student loan from the Development Bank of St. Kitts and Nevis, I thought I was one of the lucky ones. Even though I never received a statement during the in-school period, I received all my loan disbursements as requested. It was not until the eighth year of making payments that I was prompted to check my old account statements after hearing Tasha’s numerous complaints that she had never received a statement from the Development Bank in the 11 years she had her student loan. She also expressed that after three years of making payments, her student loan account balance remained the same. I received my own shocking experience when I realized that my first year of payments went to interest only, and at the end of that year, my account ending balance was exactly the same as the starting balance.

I knew then, that our stories were not an anomaly. I was very surprised to find out that the types of challenges we were experiencing were all documented in an assessment report that called for the implementation of operational changes by Caribbean student loan lenders more than ten years ago!

Tasha’s account remains unresolved, even though she had been able to get some initial responses to her longstanding questions, in December 2015.

“I didn’t feel like there wasn’t anybody to advocate for me. I was completely on my own,” she summed up her experience.

“It was my first loan, it was a huge loan and I was learning all this by myself at 22. I felt that they took advantage of me.”

When will Caribbean student loan lenders make the necessary changes to serve their student loan customers well? Student loan borrowers from Jamaica to St. Lucia, in Grenada, Dominica, and across the Caribbean all complain about the lack of transparency from lenders, non-existent accountability for mishaps and perpetual confusion about their student loans.

Student loans in the Caribbean shouldn’t be this complicated and we can’t wait much longer for serious change.

Melisa Boutin is the founder of yourmoneyworth.com and is passionate about helping Caribbean Millennials do better with money, starting with tackling student loan debt. In addition to providing personal finance resources through yourmoneyworth.com, Melisa is on a mission to bridge the gap between Caribbean Millennials and Caribbean Banks. Melisa is based in Woodbury, NY where she resides with her husband and 3-year old son. IG: melisaboutin Twitter: MelisaBoutin